Visits Available by Appointment

Smart Start for All

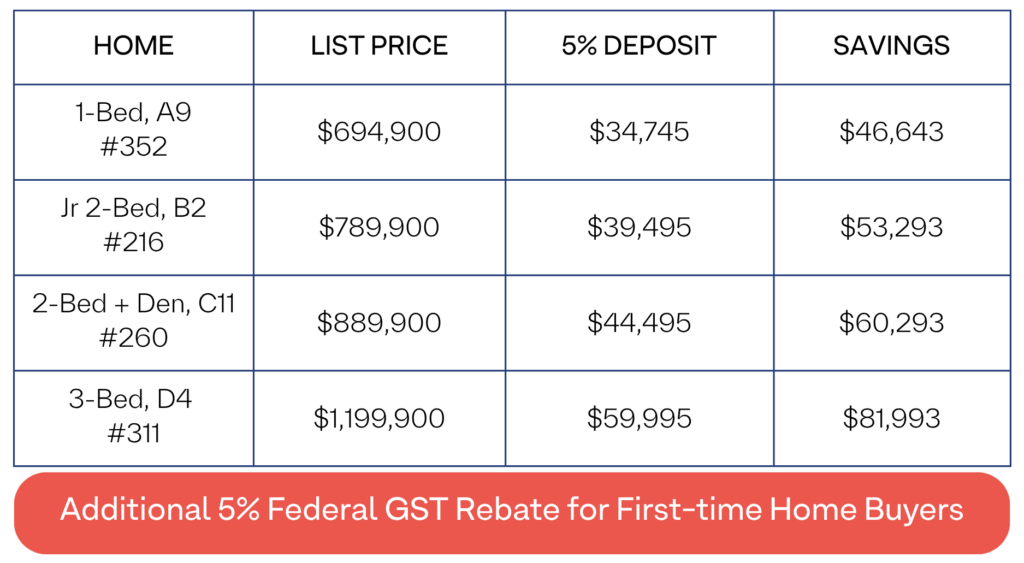

Big savings. 5% deposit. It’s never been easier to picture yourself in Frame.

There is no better time than now to buy a home at Frame, where everyone gets more.

For specific home prices, please speak to our sales representative or visit our Presentation Centre today to learn more.

*Terms and conditions apply. Deposit amount may vary by unit. Final terms, including deposit total, are subject to the terms of the Purchase Agreement.

DISCLAIMER: This is a promotion only and is NOT an offering for the sale of a strata lot. An offering for sale for the sale of a strata lot can only be made pursuant to a disclosure statement filed under the Real Estate Development Marketing Act (British Columbia). The promotion, as defined herein, is being offered by Frame Kingsway Development Limited Partnership (the “Developer”) in regard to the Frame development project located at 2751 Kingsway, Vancouver (“Frame”). The Developer will provide a credit to a purchaser of a strata lot at Frame, in an amount equal to both the BC provincial property transfer tax (“PTT”) and the federal goods and services tax (“GST”) at the currently applicable tax rate, paid by the purchaser (the “Promotion”). The payment of the PTT and GST on the full purchase price of a strata lot at Frame at the time of closing is the sole responsibility of the purchaser. The Developer does NOT pay the purchaser’s PTT and/or GST in relation to any such transaction. The Promotion credit provided by the Developer to a purchaser does not reduce the purchase price of a strata lot at Frame. Such Promotion credit shall be in an amount equal to the amount the purchaser has paid for PTT and GST on the full purchase price of a strata lot at Frame and such Promotion credit will be credited to the purchaser on the statement of adjustments at the time of closing of the purchase of a strata lot at Frame. This Promotion may be withdrawn by the Developer, without notice, at any time at the sole discretion of the Developer. The Developer may accept or reject the eligibility of any person for the Promotion in the Developer’s sole discretion, and there is no right to any purchaser to participate in the Promotion. The terms and conditions of this Promotion will merge with a purchase and sale agreement (“Purchase Agreement”) entered into between a purchaser and the Developer. Where there is an inconsistency between the Promotion and the Purchase Agreement, the terms of the Purchase Agreement shall govern.

First-Time Home Buyers (FTHB) GST Rebate are processed through the federal government. The developer does not administer the rebate program. Eligibility requirements apply.

To qualify for the FTHB GST Rebate, the buyer must:

- Be at least 18 years old.

- Be a Canadian citizen or permanent resident.

- Not have owned (or lived in a home owned by their spouse or common-law partner) in the current calendar year or the previous four years.

- Be purchasing the home as their primary place of residence.

- Be the first occupant of the home.

The FTHB GST Rebate applies to:

- New homes purchased from a builder (including those on leased land).

- Newly built homes constructed by the buyer or a contractor on land they own or lease.

- Shares in a co-operative housing corporation that grant the right to inhabit a unit.

The FTHB GST Rebate Structure

- Phased-out rebate for homes between $1 million and $1.5 million.

- 100% GST rebate on new homes valued up to $1 million.